Unlock Lower Payment Processing Fees: Negotiating Strategies for US E-commerce Merchants in 2025

Unlock Lower Payment Processing Fees: Negotiating Strategies for US E-commerce Merchants in 2025 involves understanding your current processing fees, researching alternatives, negotiating with providers, and implementing strategies to minimize costs, ultimately boosting profitability.

As an e-commerce merchant in the US, your payment processing fees can significantly impact your bottom line. Learn how to unlock lower payment processing fees: negotiating strategies for US e-commerce merchants in 2025 to improve your profitability and overall financial health.

Understanding Your Current Payment Processing Fees

Before you can effectively negotiate lower payment processing fees, you need a clear understanding of what you’re currently paying. This involves scrutinizing your monthly statements and identifying the various fees that contribute to your overall processing costs.

Types of Payment Processing Fees

Payment processing fees aren’t a single, monolithic charge. They are comprised of several different components, each contributing to the total cost.

- Interchange Fees: These are fees charged by the card-issuing bank (e.g., Visa, Mastercard) for each transaction. Interchange fees make up the largest portion of processing costs.

- Assessment Fees: These are fees charged by the card brands (Visa, Mastercard, Discover, American Express) for processing transactions on their networks.

- Processor Markup: This is the profit margin retained by the payment processor. It’s often a percentage of the transaction volume plus a per-transaction fee.

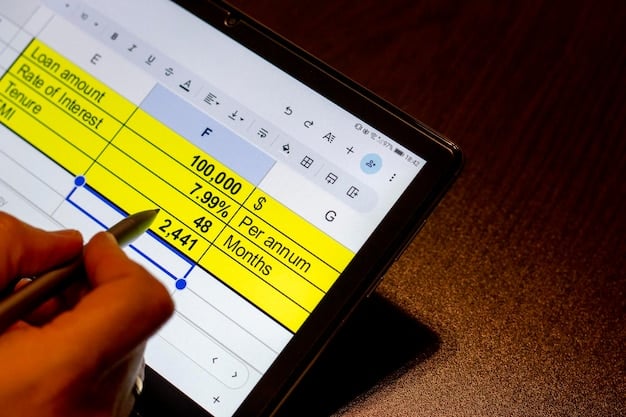

Analyzing Your Monthly Statements

Understanding your payment processing fees starts with a detailed analysis of your monthly statements. Look beyond the headline rates and delve into the specifics of each transaction.

Identify trends in your processing volume and average transaction size as these factors can influence your negotiating power.

In conclusion, a thorough understanding of your current payment processing fees is the foundation for effective negotiation. By identifying the various components of these fees and analyzing your monthly statements, you can position yourself to secure better rates and improve your bottom line.

Benchmarking Against Industry Standards

Once you have a grasp of your existing payment processing fees, it’s time to benchmark them against industry standards. This involves researching average rates and fees charged to businesses similar to yours in terms of size, industry, and transaction volume.

Researching Average Rates

Start by researching average interchange rates and processor markups for your specific industry. Several resources can provide this information.

- Industry Associations: Many industry associations publish benchmark data on payment processing fees for their members.

- Online Forums and Communities: Online forums and communities dedicated to e-commerce merchants can provide valuable insights into the rates others are paying.

- Consultants and Brokers: Payment processing consultants and brokers often have access to extensive industry data and can provide personalized benchmarking analyses.

Factors Influencing Benchmarking

When comparing your rates to industry benchmarks, keep in mind that several factors can influence the rates you’re likely to receive.

Your business risk level, processing volume, and the types of cards you accept all affect your fees. For instance, businesses considered high-risk (e.g., those with a high chargeback rate) typically pay higher rates.

Wrapping up, benchmarking against industry standards is a crucial step in preparing for negotiation. By understanding what similar businesses are paying, you can set realistic goals and negotiate with confidence.

Preparing for Negotiation

With a solid understanding of your current fees and industry benchmarks, you’re ready to prepare for negotiation. This involves gathering data, assessing your strengths, and crafting a compelling case for lower rates.

Collecting Relevant Data

Gather all relevant data related to your payment processing history, including:

- Monthly processing volume

- Average transaction size

- Chargeback rate

- Types of cards accepted

Identifying Your Strengths

Assess your strengths as a customer. Do you have a high processing volume? A low chargeback rate? A long history with the processor? These factors can strengthen your negotiating position.

Creating a Negotiation Strategy

Develop a clear negotiation strategy with defined goals and tactics. Determine the specific rates you’re aiming for and be prepared to walk away if the processor isn’t willing to meet your needs.

In short, thorough preparation is key to successful negotiation. By collecting relevant data, identifying your strengths, and crafting a strategic approach, you can increase your chances of securing lower payment processing fees.

Negotiation Tactics and Strategies

Now comes the time to put your preparation into action. Employing effective negotiation tactics can help you secure the best possible rates from payment processors.

Leveraging Competition

The most powerful negotiation tactic is often leveraging competition. Get quotes from multiple payment processors and let your current processor know that you’re exploring alternatives.

Most processors are willing to negotiate to retain your business, especially if you have a strong track record.

Highlighting Your Strengths

Emphasize your strengths as a customer.

For instance, if you’re a long-term client with a low chargeback rate, highlight this to demonstrate you’re a reliable and valuable customer.

Negotiating Beyond Rate

Don’t focus solely on the percentage rate. Negotiate other terms such as:

- Transaction fees

- Setup fees

- Monthly minimums

These fees can add up significantly over time.

To summarize, effective negotiation involves leveraging competition, highlighting your strengths, and negotiating terms beyond the percentage rate. By employing these tactics, you can maximize your chances of securing lower payment processing fees.

Exploring Alternative Payment Solutions

Sometimes, the best way to lower payment processing fees is to explore alternative payment solutions. This involves considering different processors, payment methods, and pricing models to find the most cost-effective option for your business.

Evaluating Different Payment Processors

Don’t be afraid to shop around and evaluate different payment processors. Each processor has its own fee structure, strengths, and weaknesses.

Consider factors such as:

- Pricing models

- Integration capabilities

- Customer Support

- Security Features

Considering Different Payment Methods

Explore alternative payment methods that may have lower processing fees. For example:

- ACH transfers

- Digital wallets

- Cryptocurrencies

Offering these options can reduce your reliance on traditional credit cards and lower your overall processing costs.

Understanding Different Pricing Models

Familiarize yourself with the different pricing models offered by payment processors.

Common pricing models include:

- Interchange Plus Pricing

- Tiered Pricing

- Flat Rate Pricing

Each model has advantages and disadvantages depending on your business characteristics.

In conclusion, exploring alternative payment processing solutions can be a game-changer. By evaluating different processors, payment methods, and pricing models, you can find a solution that minimizes your costs and aligns with your business needs.

Building a Long-Term Cost Reduction Strategy

Negotiating lower payment processing fees is an ongoing process, not a one-time event. Build a long-term cost reduction strategy to ensure you’re always getting the best possible rates.

Regularly Reviewing Your Fees

Set a schedule to regularly review your payment processing fees, at least once a year.

This allows you to identify any changes in rates or fees and take proactive steps to address them.

Staying Informed About Industry Trends

Monitor industry trends and developments in the payment processing landscape.

New technologies, regulations, and pricing models can create opportunities to lower your costs.

Maintaining Strong Relationships with Processors

Cultivate strong relationships with your payment processors. Good communication and trust can often lead to better rates and terms.

When you work on your relationships, processors will be more willing to work with you to keep your business.

To summarize, building a long-term cost reduction strategy involves regularly reviewing your fees, staying informed about industry trends, and maintaining strong relationships with your payment processors. By implementing these practices, you can ensure you’re always getting the best possible deal on payment processing.

| Key Point | Brief Description |

|---|---|

| 🔍 Understanding Fees | Analyze statements to identify interchange & assessment costs. |

| 📊 Benchmarking | Compare your rates with industry peers for fair assessment. |

| 🤝 Negotiation | Leverage competitor offers & highlight business strengths. |

| 💳 Payment Solutions | Explore alternatives like ACH & digital wallets for lower costs. |

FAQ

Payment processing fees generally include interchange fees (charged by card-issuing banks), assessment fees (charged by card networks), and a processor markup, which is the payment processor’s profit margin.

It’s recommended to review your payment processing fees at least annually to ensure they are still competitive and to identify any potential discrepancies or areas for cost reduction.

Interchange-plus pricing is a transparent pricing model where the merchant pays the interchange fee set by the card networks, plus a fixed markup by the payment processor.

Yes, negotiating with your payment processor is possible. By gathering data, knowing industry standards, and leveraging competition, businesses can often secure better rates.

Alternative payment methods such as ACH transfers, digital wallets, and even cryptocurrencies can often have lower processing fees compared to traditional credit card transactions.

Conclusion

By understanding your existing fees, benchmarking against industry standards, preparing for negotiation, exploring alternative payment solutions, and building a long-term cost reduction strategy, US e-commerce merchants can effectively unlock lower payment processing fees in 2025 and beyond.