Fraud Prevention 2025: AI Payment Security for US E-commerce

In 2025, US e-commerce stores will leverage AI-powered payment security to combat fraud, offering real-time transaction analysis, behavioral biometrics, and machine learning algorithms for enhanced fraud prevention.

As e-commerce continues to evolve, so do the sophisticated methods employed by fraudsters. To stay ahead of these threats, US e-commerce stores must implement cutting-edge **fraud prevention in 2025: implementing AI-powered payment security** strategies.

Understanding the Evolving Landscape of E-commerce Fraud

The digital marketplace has become a breeding ground for fraudulent activities, impacting both merchants and consumers. Understanding the nature of these threats is the first step in building a robust defense.

Common Types of E-commerce Fraud

E-commerce fraud manifests in various forms, each requiring a specific approach.

- Card-Not-Present (CNP) Fraud: Occurs when a stolen credit card is used to make online purchases without the physical card being present.

- Account Takeover (ATO): Fraudsters gain unauthorized access to customer accounts and make purchases or steal personal information.

- Refund Fraud: Customers falsely claim they didn’t receive an item or that it was damaged to obtain a refund.

- Triangulation Fraud: Scammers set up fake online stores to collect credit card information, then use it for fraudulent purchases.

The Financial Impact of Fraud

E-commerce fraud has a significant financial impact, costing businesses billions of dollars each year. This includes not only direct losses from fraudulent transactions but also indirect costs such as chargeback fees, reputational damage, and increased operational expenses.

As the digital landscape evolves, it’s crucial for US e-commerce stores to invest in advanced fraud prevention technologies and strategies. Relying on outdated methods simply isn’t enough to protect against today’s sophisticated fraudsters.

In conclusion, recognizing the diverse forms and financial implications of e-commerce fraud is essential for US e-commerce stores. By understanding these threats, businesses can proactively implement robust security measures to protect themselves and their customers.

The Role of AI in Revolutionizing Payment Security

Artificial intelligence (AI) is transforming the landscape of payment security, providing e-commerce stores with powerful tools to detect and prevent fraud in real-time. AI’s ability to analyze vast amounts of data and identify patterns makes it an invaluable asset in the fight against fraud.

How AI Enhances Fraud Detection

AI algorithms can analyze various data points, such as transaction history, IP addresses, and device information, to identify suspicious patterns and anomalies that may indicate fraudulent activity.

- Real-Time Transaction Analysis: AI algorithms analyze transactions in real-time, flagging suspicious activity before it can cause damage.

- Behavioral Biometrics: AI can track user behavior, such as typing speed and mouse movements, to detect anomalies that may indicate account takeover.

- Machine Learning: Machine learning algorithms can learn from past fraudulent transactions to improve their ability to detect future fraud attempts.

By continuously learning and adapting, AI-powered fraud detection systems can stay ahead of even the most sophisticated fraud techniques. This proactive approach is essential for protecting e-commerce stores and their customers from financial losses.

In summary, AI is revolutionizing payment security by providing US e-commerce stores with the ability to detect and prevent fraud in real-time. Its ability to analyze data, identify patterns, and learn from past fraud attempts makes it a powerful tool in the fight against fraud.

Implementing AI-Powered Payment Security: A Step-by-Step Guide

Implementing AI-powered payment security can seem daunting, but it doesn’t have to be. By following a step-by-step guide, US e-commerce stores can effectively integrate these technologies into their fraud prevention strategies.

Assess Your Current Security Infrastructure

Before implementing AI-powered solutions, it’s essential to assess your current security infrastructure. This involves identifying vulnerabilities and areas where AI can provide the most benefit.

Choose the Right AI Solution

There are many AI-powered payment security solutions available, each with its own strengths and weaknesses. Consider factors such as your budget, the size of your business, and the types of fraud you’re most concerned about when choosing a solution.

Implementing AI-powered payment security requires careful planning and execution. However, the investment is well worth it, as it can significantly reduce fraud losses and protect your business from financial damage.

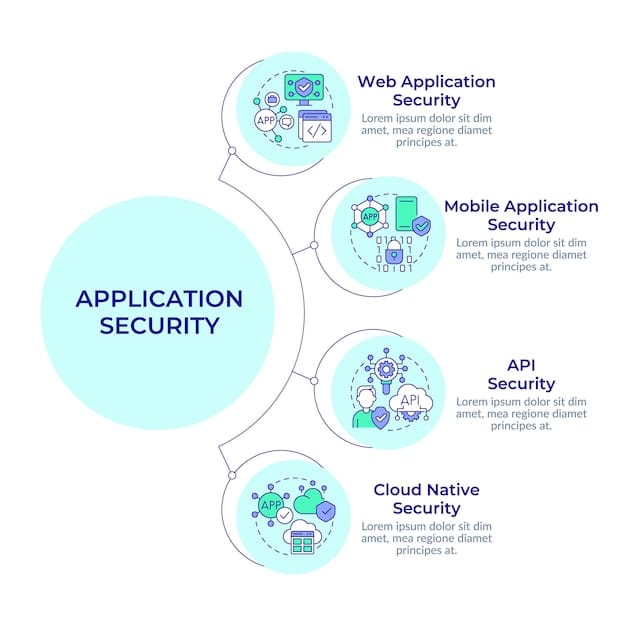

Integrating AI into Your Payment Gateway

Integrating AI into your payment gateway is a critical step in protecting your e-commerce store. This ensures that all transactions are analyzed in real-time, allowing for immediate detection and prevention of fraudulent activities.

- API Integration: Most AI-powered payment security solutions offer API integration, allowing for seamless integration with your existing payment gateway.

- Data Mapping: Ensure that your data is properly mapped to the AI system, allowing it to accurately analyze transactions.

- Testing and Monitoring: Thoroughly test the integration to ensure that it’s working correctly and monitor performance to identify any issues.

In conclusion, implementing AI-powered payment security is a strategic investment for US e-commerce stores. By assessing current infrastructure, choosing the right solution, and integrating AI into the payment gateway, businesses can significantly reduce fraud losses and protect their customers.

Key Features of AI-Powered Payment Security Systems

AI-powered payment security systems offer a range of features designed to enhance fraud detection and prevention. Understanding these features is crucial for selecting the right solution for your e-commerce store.

Real-Time Fraud Detection

Real-time fraud detection is a key feature of AI-powered payment security systems. These systems analyze transactions as they occur, flagging suspicious activity before it can cause damage.

Machine Learning Algorithms

Machine learning algorithms are used to continuously learn from past fraudulent transactions, improving the system’s ability to detect future fraud attempts. These algorithms can identify patterns and anomalies that may be missed by traditional fraud detection methods.

Key features of AI-powered payment security systems are continuously evolving, offering US e-commerce stores with proactive protection against a wide range of fraudulent activities.

Behavioral Biometrics

Behavioral biometrics is another important feature of AI-powered payment security systems. This technology tracks user behavior, such as typing speed and mouse movements, to detect anomalies that may indicate account takeover.

- Device Fingerprinting: Identifies devices used for fraudulent activity.

- Location Tracking: Detects suspicious login locations and transaction origins.

- Velocity Checks: Monitors the number of transactions made within a specific time period.

AI-powered systems can accurately identify and prevent fraudulent activities. Integrating and leveraging these key features ensures robust protection and peace of mind for both merchants and customers.

In summary, understanding the key features of AI-powered payment security systems allows US e-commerce stores to select the best solution for their specific needs. Real-time fraud detection, machine learning algorithms, and behavioral biometrics are essential components of an effective fraud prevention strategy.

The Future of Fraud Prevention: Trends to Watch in 2025

As technology continues to advance, the future of fraud prevention will be shaped by several key trends. Staying informed about these trends is essential for US e-commerce stores to maintain a competitive edge.

Enhanced Biometric Authentication

Biometric authentication methods, such as fingerprint scanning and facial recognition, are becoming increasingly popular for online payments. These methods provide an extra layer of security, making it more difficult for fraudsters to access customer accounts.

AI-Driven Risk Scoring

AI-driven risk scoring systems are becoming more sophisticated, providing a more accurate assessment of transaction risk. These systems consider a wide range of data points, such as transaction history and device information, to identify high-risk transactions.

As new threats emerge, innovation is key to staying one step ahead and ensuring payment infrastructures remain secure.

The Rise of Blockchain Technology

Blockchain technology has the potential to revolutionize payment security by providing a secure and transparent way to track transactions. Blockchain-based payment systems can reduce the risk of fraud and chargebacks, while also improving transaction efficiency.

- Decentralized Ledger: Enhances transparency and reduces the risk of data manipulation.

- Smart Contracts: Automates payment processes and reduces the potential for human error.

- Tokenization: Protects sensitive payment information by replacing it with a unique token.

In conclusion, the future of fraud prevention in 2025 will be driven by enhanced biometric authentication, AI-driven risk scoring, and the rise of blockchain technology. By staying informed about these trends, US e-commerce stores can proactively adapt their fraud prevention strategies and protect their businesses from evolving threats.

Best Practices for Maintaining AI-Powered Payment Security

Maintaining AI-powered payment security requires ongoing effort and attention. By following best practices, US e-commerce stores can ensure that their systems remain effective in detecting and preventing fraud.

Regularly Update Your AI Systems

AI systems need to be regularly updated with the latest fraud data to remain effective. This ensures that they can recognize and prevent new fraud techniques.

| Key Point | Brief Description |

|---|---|

| 🛡️ AI in Fraud Detection | AI analyzes transactions in real-time for suspicious patterns, enhancing fraud prevention. |

| ⚙️ Implementation Steps | Assess security, choose the right AI solution, and integrate into the payment gateway. |

| 📈 Future Trends | Expect enhanced biometrics, AI-driven risk scores, and blockchain technology. |

| 🔒 Regular Updates | Keep AI systems updated with the latest fraud data for optimal effectiveness. |

FAQ

▼

AI enhances fraud detection by analyzing transactions in real-time, identifying suspicious patterns, and adapting to new fraud techniques through machine learning.

▼

Key steps include assessing your current security infrastructure, choosing the right AI solution, integrating AI into your payment gateway, and continuously monitoring performance.

▼

E-commerce stores should watch for enhanced biometric authentication, AI-driven risk scoring, and the rise of blockchain technology to enhance payment security.

▼

AI payment security systems should be updated regularly, ideally on an ongoing basis, to incorporate the latest fraud data and ensure effectiveness against new threats.

▼

Behavioral biometrics tracks user behavior, such as typing speed and mouse movements, to detect anomalies that may indicate account takeover or other fraudulent activities.

Conclusion

In conclusion, leveraging **fraud prevention in 2025: implementing AI-powered payment security** is not just an option but a necessity for US e-commerce stores. By embracing AI, staying informed about emerging trends, and following best practices, businesses can protect themselves and their customers from the growing threat of online fraud.