E-commerce Payment Gateways: Best Options for US Customers in 2025

E-commerce platform payment gateways are crucial for US online businesses in 2025, influencing customer trust and transaction success through secure, diverse, and mobile-optimized payment solutions that align with evolving consumer preferences and regulatory standards.

Choosing the right **e-commerce platform payment gateways** is vital for US-based online businesses in 2025. As consumer preferences and technologies evolve, selecting a gateway that offers security, flexibility, and a seamless user experience is essential for success.

Understanding the Evolving US E-commerce Landscape

The US e-commerce market is dynamic, shaped by changing consumer behaviors and technological advancements. Understanding these trends is crucial for selecting payment gateways that align with future demands.

Mobile Commerce Dominance

Mobile commerce continues to surge, making it essential for payment gateways to provide seamless mobile payment experiences.

The Rise of Alternative Payment Methods

Consumers are increasingly using alternative payment methods like digital wallets, cryptocurrencies, and buy now, pay later (BNPL) options.

- Ensure the payment gateway supports popular mobile wallets like Apple Pay, Google Pay, and Samsung Pay.

- Consider gateways that facilitate cryptocurrency payments, catering to tech-savvy consumers.

- Integrate BNPL options to attract budget-conscious customers and increase conversion rates.

Keeping pace with these changes requires a proactive approach. By understanding and adapting to evolving consumer behaviors, e-commerce businesses can leverage payment gateways to enhance customer satisfaction and drive sales.

Key Features to Look for in a Payment Gateway

Selecting an e-commerce payment gateway involves careful consideration of several key features that can impact your business operations and customer satisfaction. Prioritizing these features ensures a robust and efficient payment processing system.

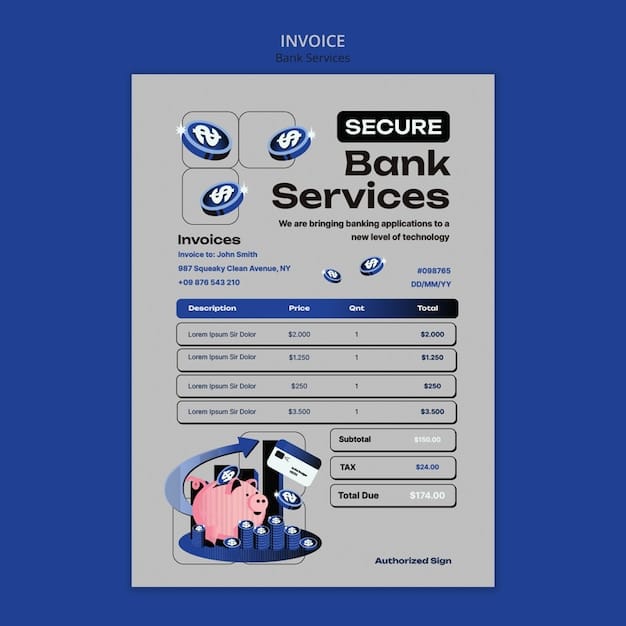

Security and Compliance

Security is paramount. Look for gateways that offer robust security measures and comply with industry standards.

Integration Capabilities

Seamless integration with your e-commerce platform and other business tools is crucial.

- Ensure the gateway is PCI DSS compliant to protect sensitive customer data.

- Look for features like tokenization and fraud detection to minimize risks.

- Confirm the gateway integrates smoothly with platforms like Shopify, WooCommerce, and Magento.

- Check for compatibility with accounting software, CRM systems, and inventory management tools.

Investing in a payment gateway with the right features is an investment in your business’s security, efficiency, and scalability. Make sure to evaluate each feature based on your specific business requirements and customer expectations.

Top Payment Gateway Options for US E-commerce in 2025

In 2025, several payment gateways stand out for their reliability, features, and suitability for US e-commerce businesses. Evaluating these options based on your specific needs can help you make an informed decision.

Stripe

Stripe is known for its developer-friendly API and comprehensive feature set.

PayPal

PayPal remains a popular choice due to its widespread acceptance and user familiarity.

Authorize.net

Authorize.net is a long-standing payment gateway offering robust security and a wide range of integrations.

Choosing the right payment gateway involves weighing the pros and cons of each option and aligning them with your business needs. By carefully evaluating these top contenders, you can select a gateway that optimizes your payment processing and enhances the customer experience.

The Impact of Transaction Fees and Pricing Structures

Transaction fees and pricing structures significantly impact your bottom line when choosing an e-commerce payment gateway. Understanding these costs is essential for financial planning and profitability.

Understanding Transaction Fees

Each payment gateway charges fees for processing transactions. These fees can vary based on the type of transaction, payment method, and the gateway’s pricing model.

Fixed vs. Variable Pricing Models

Payment gateways offer different pricing models, including fixed fees, variable rates, and tiered structures.

- Compare transaction fees across different gateways, considering both per-transaction fees and monthly fees.

- Evaluate fixed-rate pricing for consistent costs versus variable rates that fluctuate with transaction volume.

- Look for transparent pricing without hidden fees or long-term contracts.

Analyzing these factors helps you choose a payment gateway with a pricing structure that aligns with your business model and maximizes cost-efficiency.

Optimizing the Customer Payment Experience

The payment experience is a critical touchpoint in the customer journey, influencing satisfaction and conversion rates. Optimizing this experience can lead to increased sales and customer loyalty.

Streamlining the Checkout Process

A smooth and intuitive checkout process minimizes friction and reduces cart abandonment.

Offering Multiple Payment Options

Providing a variety of payment options caters to different customer preferences and increases transaction success rates.

- Simplify the checkout form to reduce the number of required fields.

- Offer guest checkout options for customers who prefer not to create an account.

- Ensure the payment page is mobile-optimized for seamless transactions on all devices.

- Support popular credit cards, digital wallets, and alternative payment methods.

- Display trust badges and security certifications to reassure customers about the safety of their payment information.

By focusing on these strategies, e-commerce businesses can create a payment experience that enhances customer satisfaction and drives conversions.

Future Trends in E-commerce Payment Gateways

The e-commerce payment landscape is continuously evolving, with emerging trends shaping the future of online transactions. Staying informed about these trends allows businesses to adapt and remain competitive.

Increased Use of Biometric Authentication

Biometric authentication methods like fingerprint scanning and facial recognition are becoming more prevalent for secure payment verification.

Integration of Blockchain Technology

Blockchain technology offers enhanced security and transparency, with potential applications in payment processing and fraud prevention.

- Explore payment gateways that support biometric authentication to enhance security and user convenience.

- Consider integrating blockchain-based payment options to cater to tech-savvy customers and reduce transaction costs.

- Monitor advancements in AI-powered fraud detection to protect against emerging threats.

Keeping pace with these trends requires a forward-thinking approach, enabling businesses to leverage the latest technologies to enhance their payment processing capabilities and stay ahead of the competition.

| Key Point | Brief Description |

|---|---|

| 🔒 Security & Compliance | PCI DSS compliance, tokenization, and fraud detection are critical. |

| 📱 Mobile Optimization | Ensure seamless mobile payment experiences for growing mobile commerce. |

| 💳 Payment Options | Support diverse methods like credit cards, wallets, and BNPL. |

| 💸 Transaction Fees | Compare fees to align with your business model. |

Frequently Asked Questions

▼

A payment gateway is a technology that facilitates online transactions by securely transmitting payment information between the customer, the merchant, and the payment processor. It is crucial because it enables e-commerce businesses to accept payments online, ensuring secure and reliable transactions.

▼

Key security features include PCI DSS compliance, which ensures the gateway meets industry standards for data security. Tokenization replaces sensitive data with non-sensitive equivalents, and fraud detection systems monitor transactions for suspicious activity.

▼

Transaction fees can significantly impact your profit margins. Lower fees mean more revenue retained per transaction. Different gateways offer varied pricing models, so comparing them is crucial to finding the most cost-effective solution for your business.

▼

Emerging trends include the increased use of biometric authentication for secure verification, the integration of blockchain technology for enhanced security and transparency, and the adoption of AI-powered fraud detection systems to combat evolving threats.

▼

Popular options include Stripe, known for its developer-friendly API; PayPal, widely accepted and recognized by consumers; and Authorize.net, offering robust security and extensive integrations. Each serves different business needs and requirements.

Conclusion

Selecting the appropriate **e-commerce platform payment gateways** for your US customers in 2025 requires a comprehensive understanding of evolving trends, key features, and pricing structures. By prioritizing security, optimizing the customer payment experience, and staying informed about future innovations, businesses can ensure a seamless and efficient payment processing system that drives success in the competitive e-commerce landscape.