Unlock Lower Payment Processing Fees: E-commerce Strategies for 2025

Unlock Lower Payment Processing Fees: Negotiating Strategies for US E-commerce Merchants in 2025 involves understanding interchange rates, negotiation tactics, and exploring alternative payment solutions to reduce costs and improve profitability.

E-commerce merchants in the US are constantly looking for ways to improve their bottom line. One significant area often overlooked is payment processing fees. The ability to unlock lower payment processing fees: negotiating strategies for US e-commerce merchants in 2025 can result in considerable savings, enhancing profitability and allowing for reinvestment in growth.

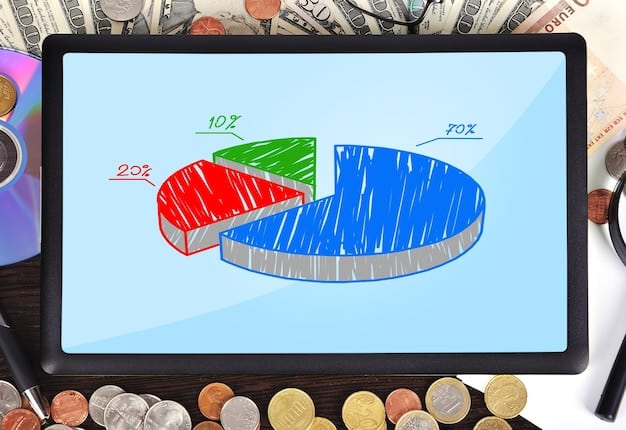

Understanding Payment Processing Fees: A Breakdown

Payment processing fees can seem complex and opaque, but understanding the different components is the first step in negotiating lower rates. These fees aren’t arbitrary; they represent the cost of facilitating transactions through various channels.

Interchange Fees

Interchange fees are charged by the card-issuing bank to the merchant’s bank for each transaction. These fees are non-negotiable and vary depending on the card type (credit, debit, rewards), merchant category code (MCC), and how the transaction is processed (card-present, card-not-present).

Assessment Fees

Assessment fees are charged by the card networks (Visa, Mastercard, Discover, American Express) to the acquiring bank. These fees cover the network’s operational costs and are also non-negotiable.

Processor Markup

The processor markup is the fee charged by the payment processor for their services, including transaction processing, security, customer support, and reporting. This is the portion of the payment processing fees that is negotiable.

- Tiered Pricing: Bundles transactions into tiers based on qualification criteria, often leading to higher costs for non-qualified transactions.

- Subscription Pricing: Charges a monthly fee plus a small per-transaction fee, which can be cost-effective for high-volume merchants.

- Interchange Plus Pricing: Passes interchange and assessment fees at cost and adds a transparent markup, offering the most clarity.

Understanding these fees allows merchants to identify areas where they can potentially negotiate or optimize their payment processing costs. By focusing on the processor markup and understanding the nuances of different pricing models, e-commerce businesses can make informed decisions to reduce expenses.

Assessing Your Current Payment Processing Statement

The second step in securing lower rates is to thoroughly review your current payment processing statement. Hidden fees, inflated rates, and inefficient pricing models are common issues that can be identified through careful analysis.

Identify Hidden Fees

Payment processing statements often contain hidden fees such as monthly minimum fees, PCI compliance fees, chargeback fees, and statement fees. These fees can add up significantly over time and should be scrutinized.

Analyze Transaction Data

Review your transaction data to understand the types of cards your customers are using, the average transaction size, and the volume of transactions processed. This information can help you identify potential areas for optimization.

- High downgrades: Determine why transactions are being downgraded to higher-cost interchange categories.

- Chargeback ratios: Implement strategies to reduce chargebacks and avoid excessive fees.

- Authorization issues: Optimize your authorization process to minimize transaction declines and related fees.

By carefully analyzing your payment processing statement, you can identify inefficiencies and areas where you may be overpaying. This information is crucial for negotiating better rates with your current processor or shopping around for a more competitive provider.

Negotiation Tactics to Lower Processing Fees

Armed with a clear understanding of your current fees and transaction data, you can begin to negotiate for lower rates. Effective negotiation requires preparation, confidence, and a willingness to walk away if necessary.

Leverage Competition

Contact multiple payment processors and request quotes. Use these quotes to negotiate with your current processor, demonstrating that you are willing to switch providers if necessary. Competition can drive processors to offer more competitive rates.

Negotiate Based on Volume

If your e-commerce business has a high transaction volume, use this to your advantage when negotiating. Processors are more willing to offer lower rates to high-volume merchants to secure their business.

Ask for Specific Reductions

Instead of asking for a general rate reduction, focus on specific areas where you believe you are overpaying. For example, ask for a reduction in the processor markup or the elimination of certain hidden fees.

- Be willing to switch: Processors are more likely to negotiate if they know you’re prepared to move your business elsewhere.

- Highlight your track record: Showcase your business’s financial stability and low-risk profile.

- Request a trial period: Ask for a temporary rate reduction to test the processor’s services and commitment.

Negotiating payment processing fees can be intimidating, but with the right preparation and approach, you can secure better rates and significantly reduce your e-commerce costs. Don’t be afraid to push for what you deserve.

Exploring Alternative Payment Solutions

In addition to negotiating with traditional payment processors, consider exploring alternative payment solutions that may offer lower fees or better terms. These solutions can provide flexibility and cost savings for your e-commerce business.

Payment Gateways

Payment gateways such as Stripe, PayPal, and Authorize.net offer competitive rates and a range of features, including fraud protection, recurring billing, and mobile payments. Compare the fees and features of different gateways to find the best fit for your business.

Payment Facilitators

Payment facilitators (PayFacs) like Square and Shopify Payments provide an all-in-one payment processing solution, handling everything from transaction processing to merchant accounts. These solutions can be particularly attractive for small businesses and startups.

Cryptocurrency Payments

Accepting cryptocurrencies like Bitcoin and Ethereum can potentially reduce payment processing fees, as these transactions bypass traditional banking networks. However, cryptocurrency payments also come with risks, including price volatility and limited adoption.

By diversifying your payment options, you can potentially lower your overall processing costs and offer your customers more flexibility. Explore the various alternative payment solutions available and choose the ones that best align with your business needs and customer preferences.

Optimizing Your E-commerce Site for Lower Fees

Optimizing your e-commerce site can also play a role in lowering payment processing fees. By implementing best practices for transaction processing and security, you can reduce chargebacks and minimize downgrades.

Address Verification System (AVS)

The Address Verification System (AVS) compares the billing address provided by the customer with the address on file with the card issuer. Using AVS can help prevent fraudulent transactions and reduce chargebacks.

Card Verification Value (CVV)

The Card Verification Value (CVV) is a three- or four-digit code on the back of credit and debit cards. Requiring customers to enter the CVV can help verify that they have physical possession of the card and reduce fraud.

3D Secure Authentication

3D Secure authentication, such as Verified by Visa and Mastercard SecureCode, adds an extra layer of security to online transactions. Customers are required to enter a password or code to verify their identity, reducing the risk of fraudulent transactions.

- Clear Product Descriptions: Provide detailed and accurate product descriptions to minimize confusion and returns.

- Responsive Customer Service: Offer prompt and helpful customer service to address issues before they escalate into chargebacks.

- Shipping and Return Policies: Clearly communicate your shipping and return policies to manage customer expectations and reduce disputes.

By implementing these optimization strategies, you can create a more secure and efficient e-commerce environment, reducing the risk of chargebacks and potentially lowering your payment processing fees.

Staying Updated with Industry Changes in 2025

The payment processing industry is constantly evolving, with new technologies, regulations, and pricing models emerging regularly. Staying updated with these changes is crucial for ensuring that you are getting the best possible rates and terms.

Monitor Interchange Rate Updates

Card networks periodically update their interchange rates, which can impact your payment processing costs. Monitor these updates and adjust your pricing strategies accordingly.

Keep Up with Regulatory Changes

Regulatory changes, such as new data privacy laws and security standards, can also affect the payment processing landscape. Stay informed about these changes and ensure that your business is compliant.

Regularly Review Your Payment Processing Agreement

Your payment processing agreement may contain clauses that allow the processor to increase fees or change terms with little or no notice. Review your agreement regularly and be prepared to negotiate if necessary.

By staying informed and proactive, you can adapt to changes in the payment processing industry and continuously optimize your costs. Be prepared to renegotiate your rates and explore new solutions as the industry evolves.

| Key Point | Brief Description |

|---|---|

| 💰 Understanding Fees | Breakdown of interchange, assessment, and processor markup. |

| 📊 Statement Analysis | Identify hidden fees and analyze transaction data for insights. |

| 🤝 Negotiation | Leverage competition and volume, ask for specific reductions. |

| 🔒 Optimization | Use AVS & CVV, clear descriptions, and good customer service. |

Frequently Asked Questions

▼

Key factors include the type of card used, transaction volume, the risk associated with your business, and the pricing model you choose with your payment processor.

▼

It’s recommended to review your statement at least quarterly to identify any discrepancies, hidden fees, or areas where you might be overpaying for services.

▼

Interchange-plus pricing offers transparency by showing the interchange fees and processor’s markup separately, allowing you to see exactly what you’re paying for each transaction.

▼

Negotiating at the end of a quarter or year, when processors are trying to meet sales targets, can provide more leverage, potentially leading to better rates and terms.

▼

Implement fraud prevention tools, provide clear product descriptions, offer responsive customer service, and clearly communicate shipping and return policies to minimize disputes.

Conclusion

Unlocking lower payment processing fees requires a proactive approach, combining thorough understanding of fees, diligent statement analysis, effective negotiation tactics, exploration of alternative payment solutions, and continuous optimization of your e-commerce site. By implementing these strategies, US e-commerce merchants can significantly reduce their payment processing costs and improve their overall profitability in 2025 and beyond.