E-commerce Payment Gateways: Top Options for US Businesses in 2025

E-commerce platform payment gateways are crucial for US businesses in 2025, offering secure and seamless transaction processing, diverse payment method support, and integration ease to optimize customer experience and drive sales growth.

Navigating the landscape of e-commerce platform payment gateways: choosing the best options for your US customers in 2025 requires a strategic approach. Selecting the right gateway can significantly impact customer satisfaction, conversion rates, and overall business success.

Understanding the Evolving E-commerce Payment Landscape

The e-commerce sector is constantly evolving, and understanding the latest trends in payment gateways is vital for US businesses. Keeping abreast of these changes allows for better decision-making and adaptation to consumer preferences.

Mobile Payments are Dominating

Mobile payments are increasingly popular, with more consumers using smartphones and tablets for online shopping. Payment gateways must be optimized for mobile devices to provide a seamless experience.

Customers Demand Security

Security remains a top concern for online shoppers. Payment gateways need to offer robust security measures, including encryption and fraud detection, to build trust. Consumers in the U.S. want to see clear indicators their payment information is protected.

- Ensure the gateway supports tokenization to protect sensitive data..

- Implement multi-factor authentication for added security.

- Regularly update security protocols to address emerging threats.

Furthermore, compliance with PCI DSS standards is essential to safeguarding cardholder data and maintaining customer confidence. Payment gateways must adhere to these standards to ensure secure transactions.

Key Features to Look for in Payment Gateways

When evaluating payment gateways for your e-commerce platform, several key features should be considered. These features can significantly impact the efficiency and effectiveness of your payment processing.

Payment Method Variety

Offering a variety of payment methods is crucial to accommodate different customer preferences. This includes credit cards, debit cards, digital wallets, and alternative payment options.

Smooth Platform Integration

Seamless integration with your e-commerce platform is essential for a smooth and hassle-free payment process. Gateways should offer easy-to-use APIs and plugins for popular platforms.

- Check for compatibility with your existing e-commerce platform

- Ensure the integration process is straightforward and well-documented

- Look for gateways that offer dedicated support for integration issues.

Another significant consideration is transaction speed. A fast and efficient payment process can reduce cart abandonment rates and improve customer satisfaction. Ensure the gateway offers quick transaction processing and minimal latency.

Top Payment Gateway Options for US E-commerce in 2025

In 2025, several payment gateways stand out as top contenders for US e-commerce businesses. Each offers specific advantages and capabilities that cater to different business needs.

PayPal

PayPal is one of the most widely recognized and trusted payment gateways globally. It offers a seamless checkout experience for customers and supports multiple payment methods.

Stripe

Stripe is a popular choice for businesses seeking a developer-friendly and highly customizable payment gateway. It supports a wide range of payment methods and offers advanced features.

- Stripe offers robust APIs for developers to create custom payment solutions.

- It supports recurring billing for subscription-based businesses.

- Stripe provides advanced fraud detection and prevention tools.

Moreover, consider emerging payment solutions like cryptocurrencies. Accepting cryptocurrencies can attract a new customer base and provide alternative payment options. However, assess the security and volatility associated with crypto payments.

Evaluating Costs and Fees

Understanding the costs and fees associated with payment gateways is crucial for making informed decisions. These costs can vary significantly between different providers, impacting your overall profitability.

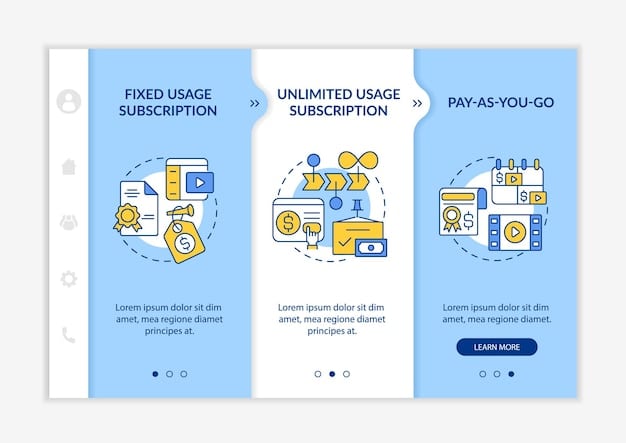

Transaction Fees

Transaction fees are the most common type of payment gateway fee, charged as a percentage of each transaction. Compare transaction fees from different providers to find the most competitive rates.

Setup Fees

Some payment gateways charge setup fees to establish an account and integrate with your e-commerce platform. Inquire about setup fees and factor them into your overall cost analysis.

- Consider the long-term cost implications of different fee structures.

- Negotiate rates with payment gateway providers based on your transaction volume.

- Evaluate the value of additional features included in the fee structure.

Additionally, consider any potential chargeback fees. Chargebacks occur when customers dispute transactions, and payment gateways may charge fees to cover the associated costs. Minimize chargebacks by implementing robust fraud prevention measures.

Optimizing the Checkout Process

Optimizing the checkout process is essential for reducing cart abandonment and improving conversion rates. A streamlined and user-friendly checkout experience can significantly enhance customer satisfaction.

Simplify the Checkout

Minimize the number of steps required to complete a purchase. Streamline the checkout process by reducing unnecessary form fields and providing clear instructions.

Build Trust Through Design

Display security badges and trust seals to reassure customers about the security of their payment information. Use a professional and trustworthy website design to build confidence.

- Offer guest checkout options to reduce friction for first-time buyers.

- Provide clear and concise error messages to guide customers through the process.

- Use progress indicators to show customers where they are in the checkout process.

Furthermore, ensure your checkout process is mobile-friendly. Optimize the layout and design for mobile devices to provide a seamless experience for mobile shoppers. Test the checkout process on different devices and browsers to ensure compatibility.

Looking Ahead: 2025 and Beyond

As we look ahead to 2025 and beyond, several emerging trends will shape the future of e-commerce payment gateways. Staying informed about these trends will enable businesses to stay ahead of the curve.

Biometric Authentication

Biometric authentication, such as fingerprint scanning and facial recognition, will become more prevalent. These methods offer enhanced security and a more convenient checkout experience.

AI and Machine Learning

AI and machine learning will play an increasingly important role in fraud detection and prevention. These technologies can analyze transaction data to identify and prevent fraudulent activity in real-time.

- Blockchain technology may offer secure and transparent payment solutions.

- Instant payments will enable faster and more efficient transactions.

- Personalized payment experiences will cater to individual customer preferences.

In conclusion, selecting the best e-commerce platform payment gateway for your US customers in 2025 requires careful consideration of various factors. By understanding the evolving landscape, key features, costs, and emerging trends, you can make informed decisions that drive business success.

| Key Aspect | Brief Description |

|---|---|

| 💳 Payment Methods | Offer diverse options (cards, wallets) for customer convenience. |

| 🔒 Security | Ensure data encryption and PCI compliance to build trust. |

| 🤝 Integration | Choose gateways that seamlessly integrate with your e-commerce platform. |

| 🚀 Optimization | Simplify checkout to reduce abandonment and improve conversions. |

FAQ

▼

A payment gateway is a technology that authorizes credit card or direct payments processing for e-businesses and online retailers. It acts as a middleman between your store and the bank.

▼

Mobile payment options are critical because an increasing number of consumers use their mobile devices for online shopping. Optimizing for mobile ensures a seamless shopping experience and increased sales.

▼

Transaction fees are charges applied by payment gateways based on a percentage of the total amount of each transaction. These fees vary among different providers, so it’s essential to compare them.

▼

PCI DSS (Payment Card Industry Data Security Standard) compliance ensures payment gateways meet security standards to protect cardholder data. This compliance is necessary for maintaining customer trust.

▼

You can optimize by simplifying the checkout form, providing clear instructions, and displaying trust badges. Mobile-friendly design and guest checkout options can also greatly improve customer experience.

Conclusion

Choosing the right e-commerce payment gateway for your US business in 2025 involves careful evaluation of payment methods, security, integration capabilities, and fees. Staying informed about industry trends and customer demands ensures the selection of a gateway that promotes growth, security, and customer satisfaction.